Speed to Savings

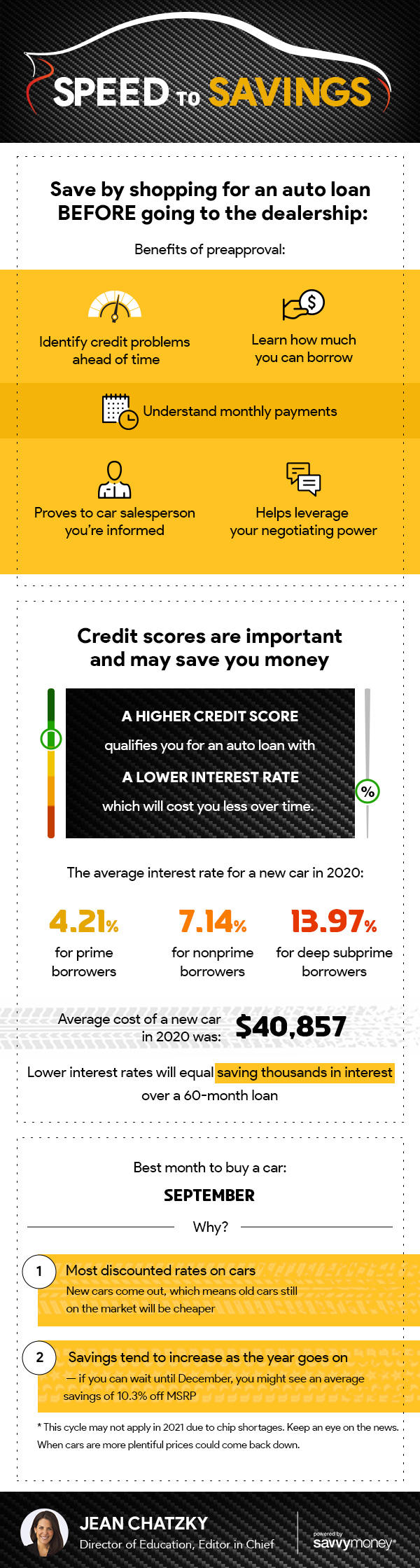

Kohler Credit Union members are able monitor their credit by using Credit Insights, our free credit monitoring tool available in digital banking. Want to learn more about credit scores? Click here to read more about your credit score and why it’s important or check out our credit score videos on It’s a Money Thing.