December 1, 2021

by: SavvyMoney

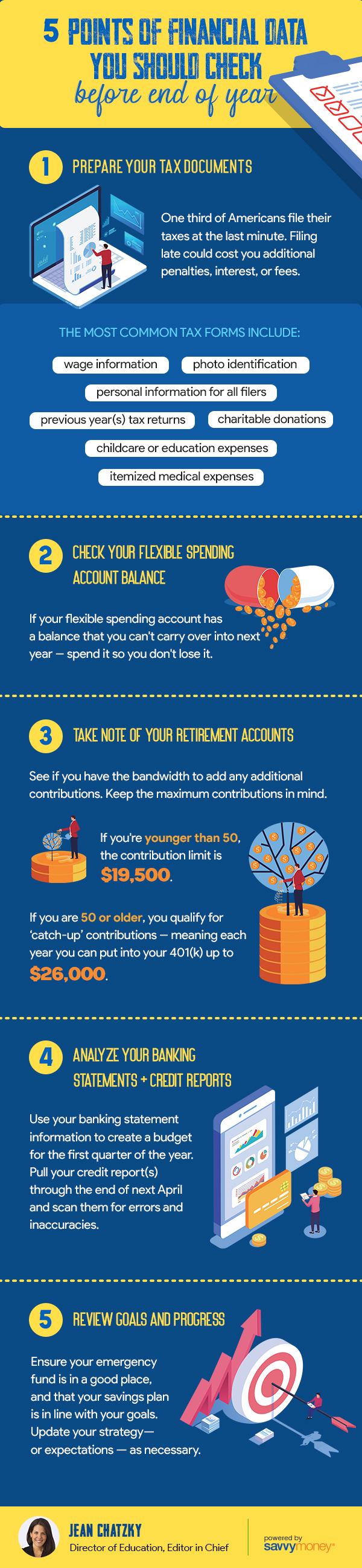

5 points of Financial Data you should check before end of year.

- Prepare your tax documents – One third of Americans file their taxes at the last minute. Filing late could cost you additional penalties, interest, or fees. Most common tax forms include:

- Wage information

- Photo identification

- Personal information for all filers

- Previous year(s) tax returns

- Charitable donations

- Childcare or education expenses

- Itemized medical expenses

- Check your flexible spending account balance – If your flexible spending account has a balance that you can’t carry over into next year - spend it so you don’t lose it.

- Take note of your retirement accounts – See if you have the bandwidth to add any additional contributions. Keep the maximum contributions in mind.

- If you’re younger than 50 the contribution limit is $19,500.

- If you are 50 or older, you qualify for ‘catch-up’ contributions – meaning each year you can put into your 401K up to $26,000.

- Analyze your bank statements + Credit Reports – Use your bank statement information to create a budget for the first quarter of the year. Pull your credit reports(s) through the end of the next April and scan them for errors and inaccuracies.

- Review Goals and Progress – Ensure your emergency fund is in a good place, and that your savings plan is in line with your goals. Update your strategy – or expectations – as necessary.

Post your comment

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments