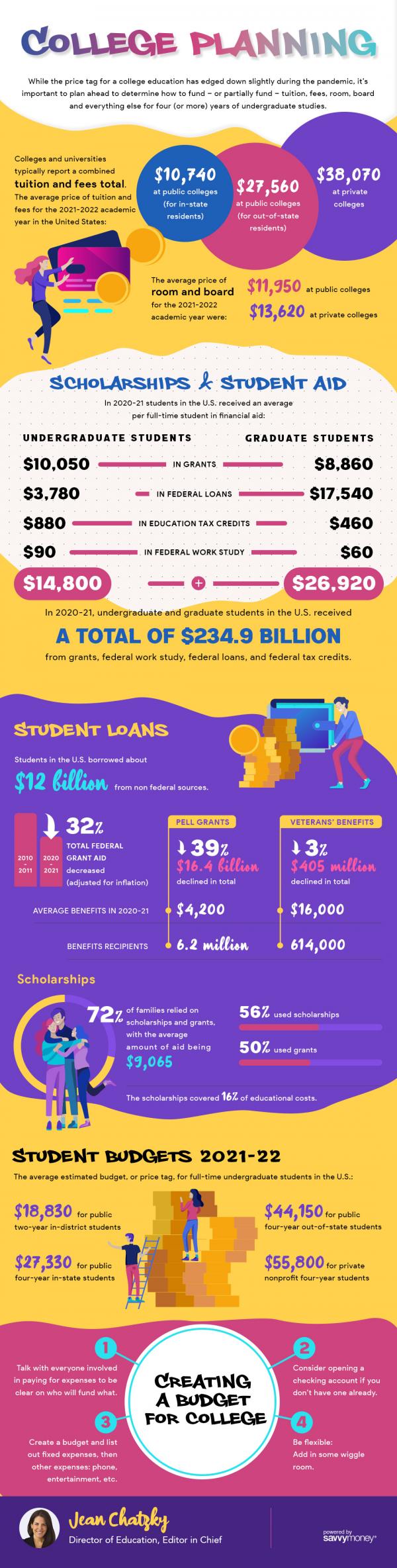

College Planning

While the price tag for a college education has edged down slightly during the pandemic, it’s important to plan ahead to determine how to fun – or partially fun – tuition, fees, room, board and everything else for four (or more) years of undergraduate studies.

College and universities typically report a combined tuition and fees total. The average price of tuition and fees for the 2021-2022 academic year in the United States”

- $10,740 at public colleges (for in-state residents)

- $27,560 at public colleges (for out-of-state residents)

- $38,070 at private colleges

The average price of room and board for the 2021 – 2022 academic year were:

- $11,950 at public colleges

- 13620 at private colleges

Scholarships & Student Aid

In 2020 -21 students received an average per full-time student in financial aid:

|

|

Undergraduate Student |

Graduate Student |

|

In Grants |

$10,050 |

$8,860 |

|

In Federal Loans |

$3,780 |

$17,540 |

|

In Educational Tax Credits |

$880 |

$460 |

|

In Federal Work Study |

$90 |

$60 |

|

Total |

$14,800 |

$26,920 |

In 2020-21, undergraduate and graduate students in the U.S. received a total of $234.9 billion from grants, federal work study, federal loans, and federal tax credits.

Student Loans

Students in the U.S. borrowed about $12 billion from nonfederal sources. 2010-2011 compared 2020-2021 total federal grant aid decreased by 32%. (adjusted for inflation)

Scholarships

- 72% of families relied on scholarships and grants with the average amount of aid being $9065

- 56% use scholarships

- 50% used grants

- The Scholarships covered 16% of educational costs.

Student Budget 2021-22

The average estimate budget or price tag, for full-time undergraduate students in the U.S.:

- $18,830 for public two-year in district students

- $27,330 for public four-year in-state students

- $44,150 for public four-year out-of-state students

- $55,800 for private nonprofit four-year students

Create a Budget for College

- Talk with everyone involved in paying for expenses to be clear on who will fund what.

- Consider opening a checking account if you don’t have one already

- Create a budget and list out fixed expenses, then other expenses: phone entertainment, etc.

- Be flexible: Add in some wiggle room.

Post your comment

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments