Speed to Savings

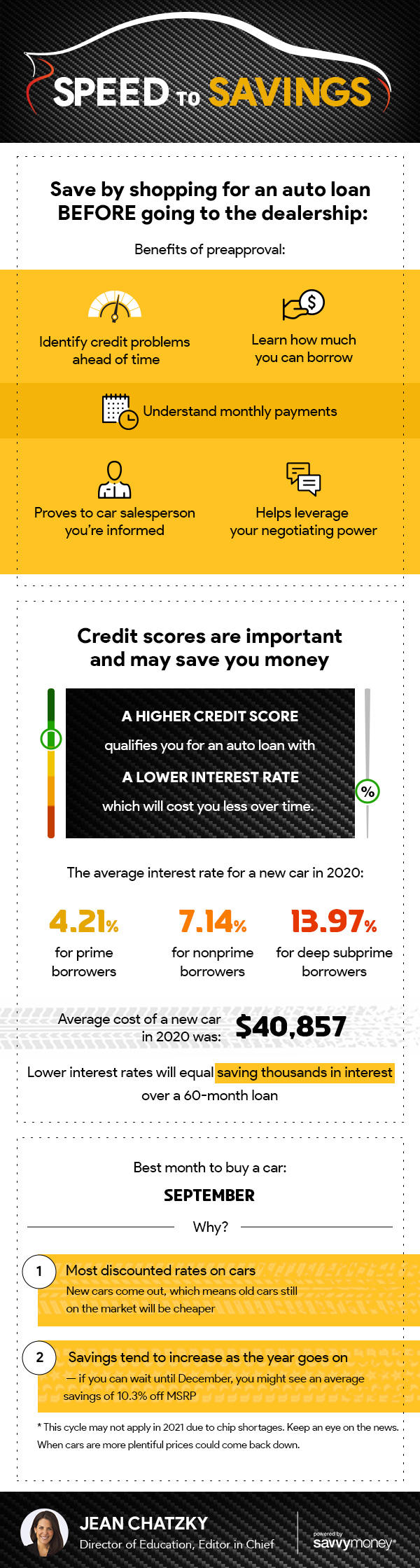

Save by shopping for an auto loan BEFORE going to the dealership:

Benefits of preapproval:

- Identify credit problems ahead of time

- Learn how much you can borrow

- Understand monthly payments

- Proves to car salesperson you’re informed

- Helps leverage your negotiating power

Credit scores are important and may save you money. A higher credit score qualifies you for an auto loan with a lower interest rate. The average interest rate for a new car in 2020:

- 4.21% for prime borrowers

- 7.14% for nonprime borrowers

- 13.97% for deep subprime borrowers

Average cost of a new car in 2020 was $40,857. Lower interest rates will equal savings thousand in interest over a 60-month loan.

Best Month to buy a car? September

- Most discounted rates on cars: New cars come out which means old cars still on the market will be cheaper

- Savings tend to increase as the years goes on: if you can wait until December, you might see an average savings of 10.3% off MSRP (This cycle does not apply in 2021 due to chip shortages. Keep an eye on the news. When cars are more plentiful prices could come back down.)

Written by Jean Chatzy Director of Education. Powered by SavvyMoney.

Post your comment

Comments

No one has commented on this page yet.

RSS feed for comments on this page | RSS feed for all comments